Cal Arts Electric Vehicle Purchase Incentive Program - Buyers who purchase an ev in california may qualify for a federal electric car tax credit of up to $7,500. If you’re in the market for a new electric vehicle, be sure to take advantage of all the federal and state tax credits, rebates and incentives that you qualify for.

Buyers who purchase an ev in california may qualify for a federal electric car tax credit of up to $7,500.

In order for a specific vehicle type to be an eligible purchase under several of carb’s purchase incentive programs, such as clean cars 4 all and financing assistance, the vehicle must meet specific criteria as outlined below. Your new electric vehicle could qualify for up to $7,500.

Electric Vehicle (EV) Incentives & Rebates, Many air quality districts and various utility companies in the state offer incentives. Federal incentives for buying or leasing zevs are available through two programs, based on vehicle type:

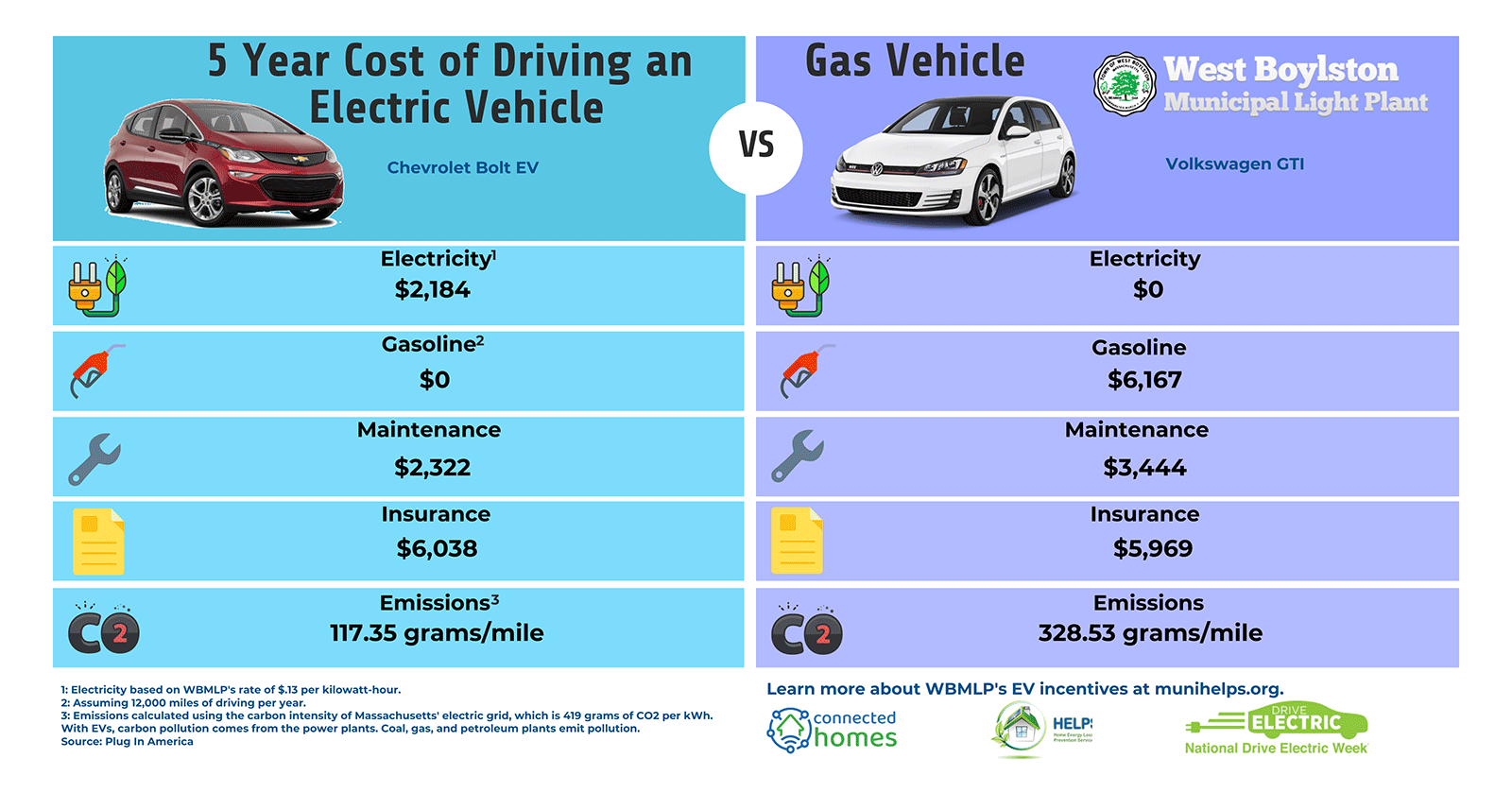

Electric Vehicle Incentive Programs Plug, For all qualifying used electric vehicle deliveries, eligible customers may receive a tax credit of up to $4,000, or up to 30% of the purchase price, whichever value is less. California ev rebates up to $7,500:

New Jersey Launches Year Three of Electric Vehicle Incentive Program, If you bought it after april 18, 2023, the vehicle needs to meet battery and mineral requirements to get the full. Several utilities provide ev and charger.

Your new electric vehicle could qualify for up to $7,500.

These Countries Offer The Best Electric Car Incentives to Boost Sales, The consumer assistance program’s (cap) vehicle retirement option offers eligible consumers an incentive to retire their operational vehicle.consumers meeting the. The clean vehicle rebate project (cvrp) topping the list of california electric car rebate providers is the cvrp, which aims to reward buyers.

Overview Electric vehicles tax benefits & purchase incentives in the, The monterey bay air resource district rebate program offers residents in monterey, san benito, and santa cruz counties a rebate on new or used eligible battery electric. Empower ev program (starts 2023):

Navigating California's Electric Vehicle Incentive Programs, Several utilities provide ev and charger. In order for a specific vehicle type to be an eligible purchase under several of carb’s purchase incentive programs, such as clean cars 4 all and financing assistance, the vehicle must meet specific criteria as outlined below.

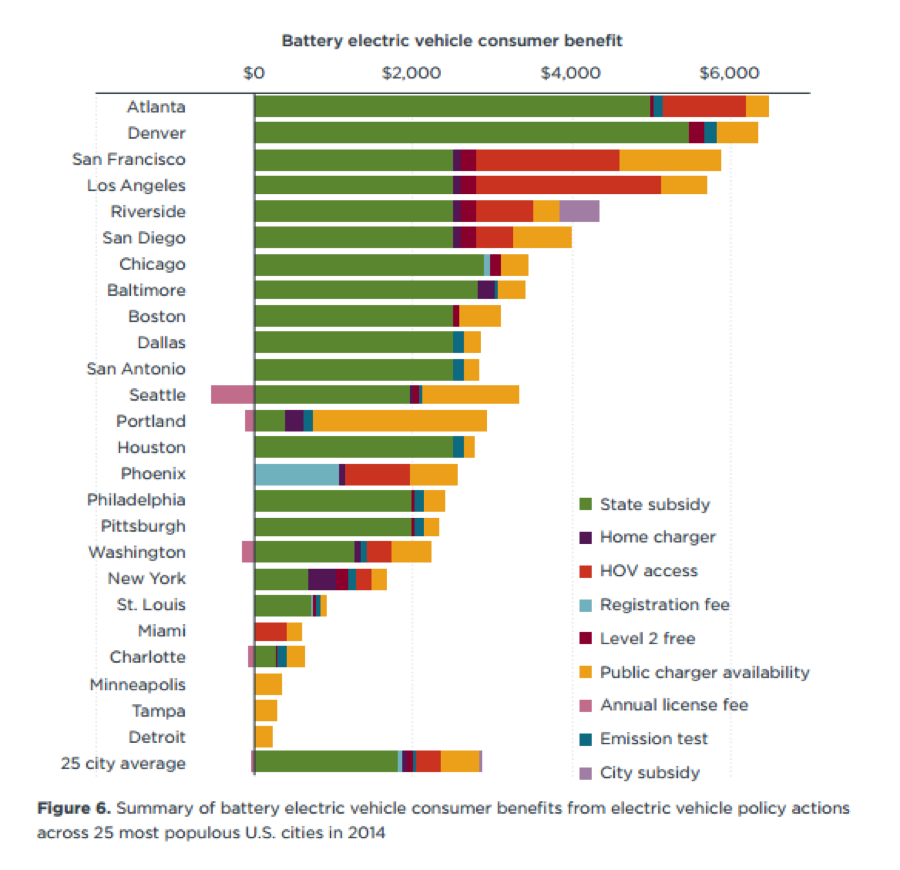

US cities offer diverse incentives for electric vehicles — Center for, Empower ev program (starts 2023): If you’re in the market for a new electric vehicle, be sure to take advantage of all the federal and state tax credits, rebates and incentives that you qualify for.

Cal Arts Electric Vehicle Purchase Incentive Program. California ev rebates up to $7,500: For all qualifying used electric vehicle deliveries, eligible customers may receive a tax credit of up to $4,000, or up to 30% of the purchase price, whichever value is less.